Truman State University Foundation

Investment Policy

Donors who create endowed funds are investing in the future excellence of Truman State University. Endowed funds are managed in the University’s permanent endowment portfolio.

The Truman State University Foundation has established an investment and spending policy that provides income for the University in perpetuity, while protecting and growing the principal. A portion of the earnings are awarded for the fund’s designated annual purpose; remaining earnings are reinvested to ensure long-term growth of the principal. Annual awards are based on the rolling three year average of investment returns.

The overall philosophy, recommended selection and retention of investment managers, monitoring and evaluation of performance, and policies for the distribution of investment earnings and spending are the responsibility of the Investment Committee of the Foundation Board.

Truman’s assets are managed by employee owned NEPC, one of the industry’s largest independent, full-service investment consulting firms, serving over 350 retainer clients with total assets over $1.3 trillion. NEPC has built one of the largest dedicated research teams in the consulting industry. Focused on innovative strategies, market trends and new products, their expertise spans asset allocation, traditional investments, and alternative strategies.

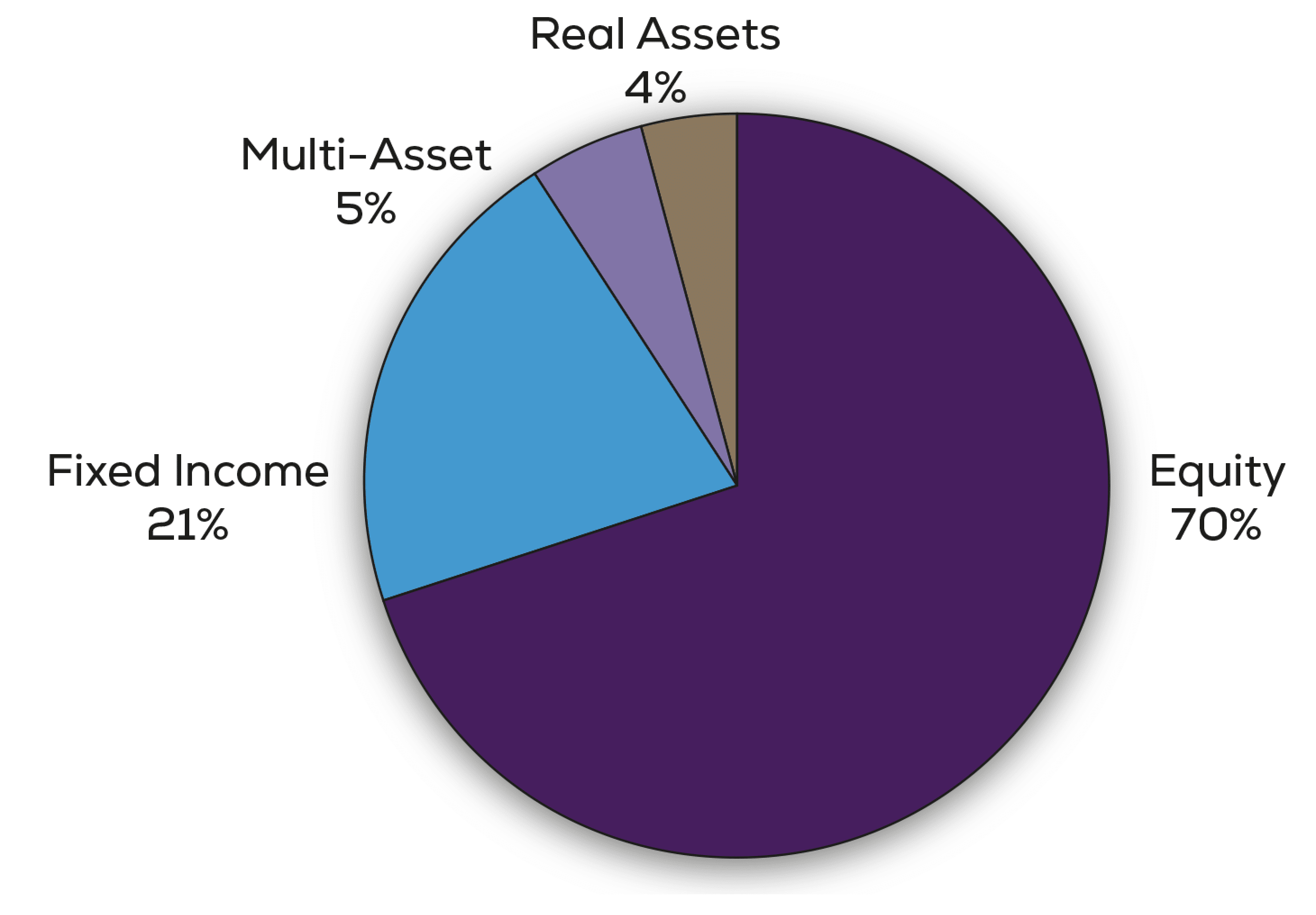

Current target fund asset allocation ranges are as follows: